Wallet$mart App

BUSINESS SITUATION

Academics at Western Sydney University introduced the initial concept of building a financial literacy App to address the predominant need to build financial literacy and financial capability of university students with a particular focus on the students ‘at-risk’ of being susceptible to financial adversities. It aims to assist students as they make important financial decisions which can impact on their ‘whole of life’ experience.

SOLUTION

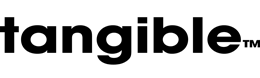

As a collaboration between WSU and UniBank, Tangible was the agency that was approached to make this idea become a reality. We started by selecting platforms and channels to execute a seamless system. Understanding that it was not a subject area that garnered mass interest. We devised a concept that integrated gamification elements to encourage user participation. Without financial incentive, we knew it would be a challenge to keep students engaged. We also knew that design would play a pivotal role.

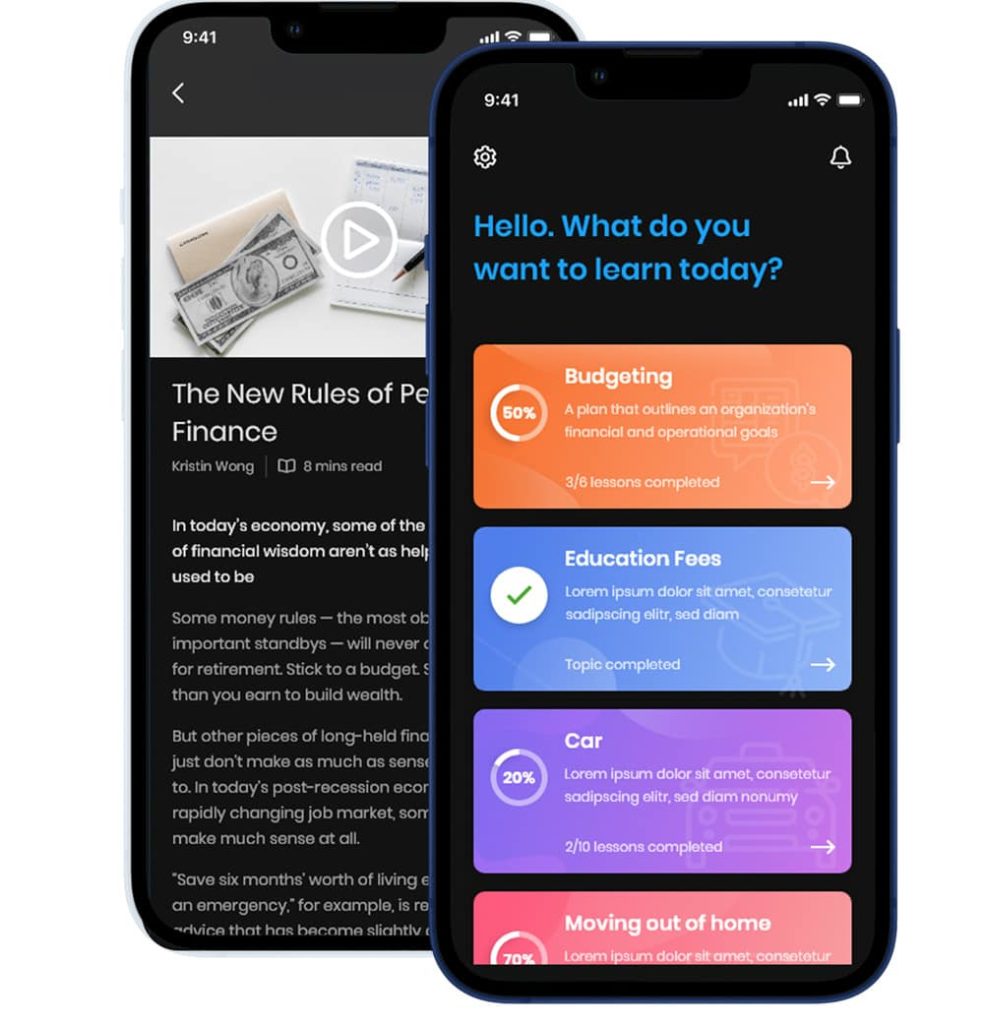

Students were required to complete an entrance test (and provided with a ‘Wallet$mart IQ score’) to determine their level of financial literacy and financial capability prior to using the app. This information was used to direct students to the areas where they were most in need. The app covered seven financial management topic areas broken down into a number of bite-sized lessons and included short videos and quiz questions. Students were encouraged to complete the lessons by earning digital badges. The app also included a budgeting tool to assist them with managing their finances. Students who had worked through all lessons successfully were provided with the opportunity to complete an exit assessment to see if their ‘Wallet$mart IQ score’ improved.

RESULT

The Wallet$mart app improved the financial capability of students by providing just-in‑time information that was relevant to financial decisions that university students were making or considering during the trial period. The app influenced financial capability of students in the following ways:

• Students improved their knowledge and understanding of financial concepts with more than an 80% improvement overall on pre/post‑test results;

• The bite-sized lesson content, including the combination of short videos and quizzes that were able to be accessed over an extended period of time, allowed many of the participants to put what they were learning into practice during the trial period;

• More than 75% of survey respondents indicated that their financial capability had increased since using the Wallet$mart app;

• Increased awareness of topics that were relevant to students’ personal circumstances;

• Students made more informed decisions on their immediate financial situation;

• Improved student skills such as budgeting;

• Made students feel more confident about making financial decisions;

• Positively influenced student attitudes to personal financial management.

CLIENT

UNIBANK / WSU

PROJECT DATE

May 05, 2021